July 01, 2019

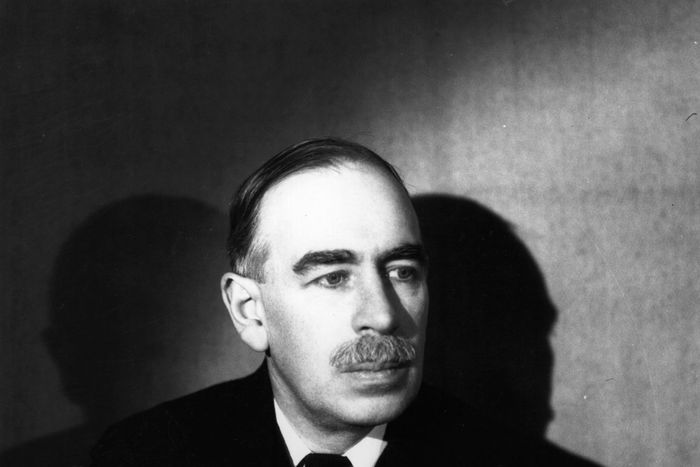

Where Keynes and the Keynesians get it wrong

I learnt my economics from a school that respected Keynes. They were quite clear that Keynes had become an excuse for willy-nilly government spending but still accepted that Keynes was right in how to cure a deflation or a recession. Spending up big during a recession was good but not during more prosperous times. Politicians of course want to spend up big at all times.

There is a long article here that sets out in detail why Keynes was wrong altogether. He should not be followed even during a recession. I am going to be so bold as to try to explain why in just a few paragraphs. If I seem to be missing something please go to the long article that I have mentioned.

Keynes was a Leftist and his thinking was typically Leftist and wrong. Leftists think only in big aggregates like race, class, Kulaks and sex. Considering the individual seems to be beyond them.

And Keynes did exactly that. Instead of looking at the complexities of a modern industrial economy he looked at one of the biggest aggregates of all: Aggregate demand. So to him recessions and depressions were not explained by the myriad details actually at work in an economy at the time. He saw recessions as glaringly simple: A recession was a deficiency in aggregate demand. And that was easy to fix: Let the government spend up big and thus increase aggregate demand.

But if it matters at all, aggregate demand is a symptom not the problem itself. You have to look at what in detail has damaged economic activity. You have to go into that boring nitty gritty activity of looking for the source of the problem or problems.

And you will very often find that the problem is some sort of government meddling. The great crash of 2008, for instance, was the result of huge Federal interference in the housing market. Banks were virtually forbidden from lending carefully. Checking whether a person would likely be able to afford his mortgage payments was "racist". And housing is a BIG sector of the economy so when the inevitable crisis resulting from many loans in default arrived, the crash and losses were very big indeed.

So the cure for a depression will often be a REDUCTION of government activity, not an increase in it. Keynes got it exactly wrong.

And Keynes also overlooked that recessions have a function. If there are businesses that are no longer prospering, a recession will normally send them broke. And the resources (manpower, real estate etc) freed up by that collapse will become available for use by startups who can use them more productively: Schumpeter's "creative destruction". And if such a reallocation of resources is allowed to run its course without interference it will normally be short-lived. Business will pickup again within as little as a year.

So Keynes was wrong at the most basic level. Recessions are not a problem at all. They are a normal, natural and desirable process of reallocating resources more efficiently. They are a healing episode wherein senile businesses are put out to grass while new businesses take over. They do give pain in some quarters but there is no gain without pain

Go to John Ray's Main academic menu

Go to Menu of longer writings

Go to John Ray's basic home page

Go to John Ray's pictorial Home Page

Go to Selected pictures from John Ray's blogs